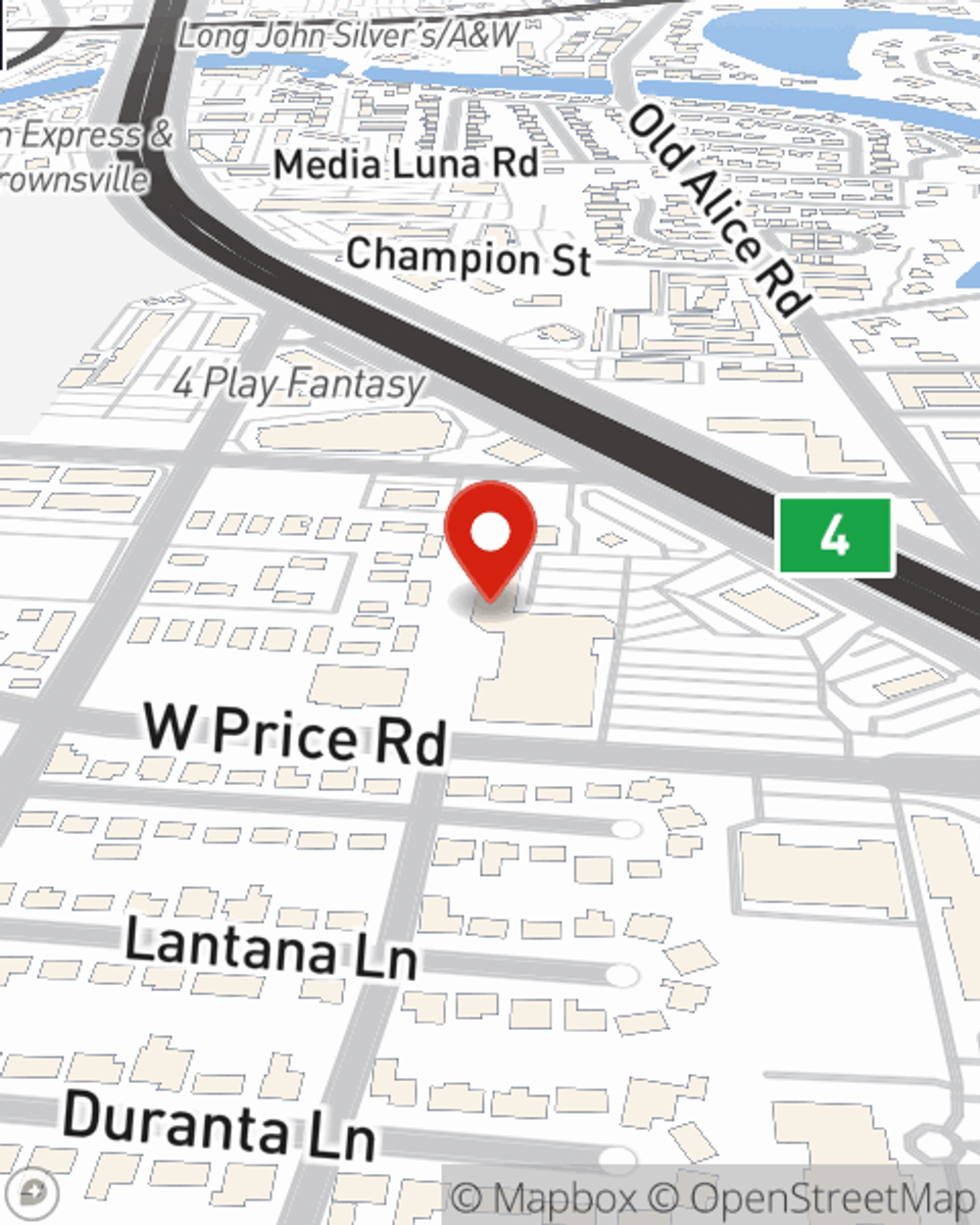

Business Insurance in and around Brownsville

Looking for small business insurance coverage?

Insure your business, intentionally

Help Prepare Your Business For The Unexpected.

Whether you own a a confectionary, a window treatment store, or a hair salon, State Farm has small business coverage that can help. That way, amid all the various decisions and moving pieces, you can focus on what matters most.

Looking for small business insurance coverage?

Insure your business, intentionally

Strictly Business With State Farm

You are dedicated to your small business like State Farm is dedicated to reliable insurance. That's why it only makes sense to check out their coverage offerings for commercial liability umbrella policies, worker’s compensation or commercial auto.

With over 300+ businesses eligible to be insured by State Farm, look no further for your business coverage needs. Agent Trae Pena is here to help you explore your options. Call or email today!

Simple Insights®

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

Trae Pena

State Farm® Insurance AgentSimple Insights®

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.